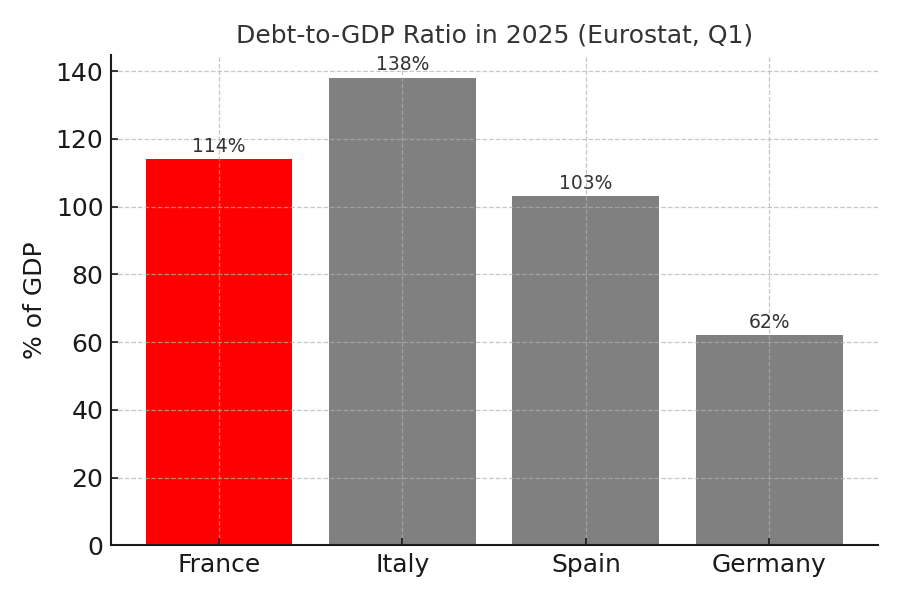

France’s public debt in 2025: what the numbers tell us

Key figures (simple overview)

- Total public debt: about €3.3 trillion.

- Debt-to-GDP ratio: roughly 114% (the debt is bigger than one year of the economy).

- Budget deficit (2025): around 5.8% of GDP (EU rule is 3%).

- EU comparison: France’s debt ratio is among the highest in the EU (only Greece and Italy are higher). The euro area average is much lower.

What does “debt-to-GDP” mean?

It shows how big a country’s debt is compared to the size of its economy. If the ratio is 100%, the debt equals one year of everything the country produces. A higher number means a heavier debt burden.

Political context (why this is in the news)

- The government announced a savings plan of about €44 billion to shrink the deficit.

- One proposal (very controversial) even suggested scrapping public holidays to boost output.

- Opposition parties threatened no-confidence votes, so the government’s position is fragile.

- Public support for cutting holidays is low, and protests underline how difficult budget reforms are.

Economic risks (in plain language)

- Rising interest costs: When rates go up, borrowing becomes more expensive. France already spends tens of billions per year on interest—money that can’t go to schools or hospitals.

- Credit rating pressure: If rating agencies downgrade France, borrowing could become even more expensive.

- Investor nerves: Political fights make it harder to pass reforms, which can worry markets.

Why this matters (for France and Europe)

- France is the second-largest economy in the euro area. If France struggles, it can affect the whole region.

- EU fiscal rules say deficits should be below 3% and debt near 60%. France being far above those levels puts the credibility of the rules to the test.

- Higher French borrowing costs can push up borrowing costs in other countries too.

Trends & what to watch

- Deficit path: Can France reduce the deficit toward 3% without hurting growth?

- Reforms: Pension, spending control, and better tax collection are key—but politically hard.

- New priorities: Defense, energy support, and climate investments make cutting the deficit tougher.

FAQ

Why is France’s debt so high?

Because the government has run budget deficits for many years. Crises (like COVID-19) also pushed spending up. Interest costs and slow growth make it harder to bring debt down.

What is France’s debt-to-GDP in 2025?

About 114%. That means the total debt is larger than one year of the economy.

How does France compare to Italy?

Italy’s debt ratio is even higher (around the upper-130s % of GDP). But France’s ratio is still far above the EU target.

Will France be downgraded by rating agencies?

It’s a risk. If deficits stay high and reforms stall, borrowing could get more expensive after a downgrade.

Source: Eurostat (gov_10q_ggdebt), European Commission. This explainer uses the latest official figures available in 2025.

Further Reading

Analysis & data you might have missed

The Digital Euro: Europe’s Leap Into the Future of Money

Student-friendly explainer of what the digital euro is, why the ECB wants it, how it could work, privacy questions, and what it means for people and banks.

Netherlands National Debt in 2025: What the Live Counter Shows (and What It Means)

EU Debt Map visualizes the Netherlands’ public debt as a real-time estimate derived from Eurostat. This article explains what the live number, the €-per-second pace, and the debt-to-GDP context mean—and how to interpret them responsibly.

The Silent Bomb Beneath Europe: France’s Debt Spiral and the Coming Reckoning for the Euro

A New York Times–style feature on debt-to-GDP, creative accounting, inflation risk, and why France’s rising debt could shake the euro.

Germany’s Debt Paradox: How Fiscal Discipline Became an Economic Trap

Germany’s falling debt-to-GDP ratio hides a deeper problem. Bound by its strict 'debt brake' while facing urgent needs for investment, Europe’s largest economy is caught between prudence and paralysis.

Debt-to-GDP Ratios of EU Countries in 2025

A full overview of government debt across all 27 EU countries in 2025, explained in simple terms with rankings, trends, and key insights.

Europe's Trillion-Euro Question: When Is National Debt an Investment?

As Europe faces the colossal costs of the green and digital transitions, the old rules of austerity are being challenged by a new logic: borrowing not for consumption, but for survival and future growth.