EU debt interest vs schools and hospitals: 2025 explained

This article is written in simple language so students and general readers can follow.

What this article shows

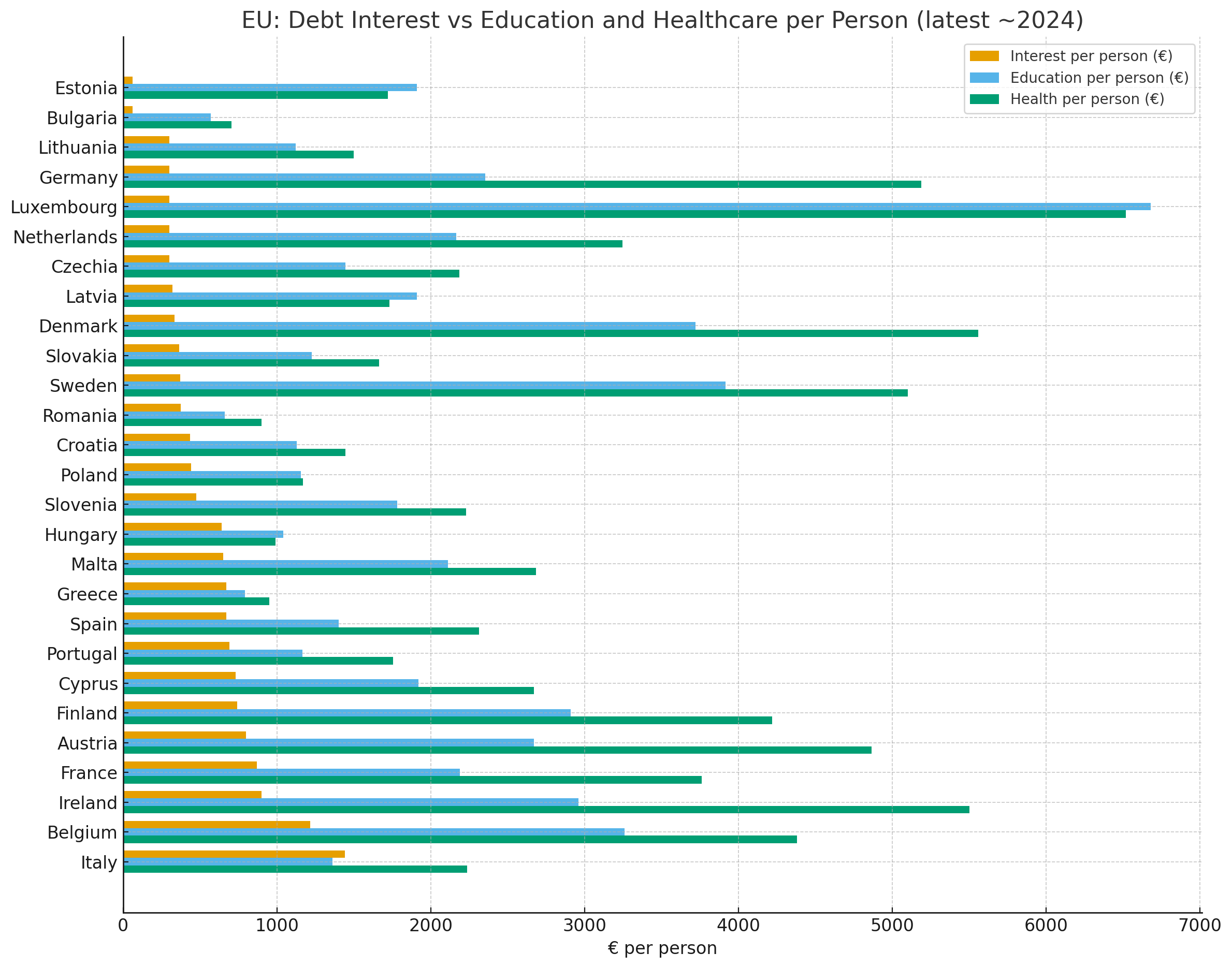

In 2025, many EU governments spend a lot of money paying interest on their public debt. But they also spend huge amounts on schools and hospitals. This article compares those three areas — interest, education, and healthcare — to see which countries spend more on debt and which invest more in people.

Per-country breakdown (latest data)

The table below shows spending in billions of euros and per person. Data are mostly from 2024, because 2025 figures are not fully available yet.

Top 3 countries by interest burden (per person)

- Italy: About €1,440 per person. Italy spent ~€85 billion on interest in 2024, nearly the same as on all education nationwide.

- Belgium: Around €1,200 per person. Belgium’s interest bill is rising because of high debt and higher rates.

- France: About €870 per person. France paid ~€59 billion in 2024. The national auditor warns it could pass €100 billion a year by 2029.

Note: Ireland also pays close to €900 per person, but total interest spending is smaller.

Where interest eats into social spending

In some high-debt countries, debt service takes away money that could go to schools or hospitals:

- Italy: Interest (~€85 bn) was slightly higher than the education budget (~€80 bn). This is rare in Europe.

- Greece: Interest (~€7 bn) is close to education (~€8 bn) and healthcare (~€10 bn). It used to be worse but is now slowly improving.

- Portugal: Interest (~€7 bn) is about half of the education budget and ~40% of the health budget. Debt is still over 110% of GDP.

Countries that invest more in people

Other EU countries spend far more on social services than on debt:

- Nordic countries: Sweden, Denmark, and Finland spend many times more on schools and hospitals than on debt. Sweden spends ~14% of its budget on education and 19% on health, but less than 1% on interest.

- Germany: Health (~€436 bn) is nearly 20× its interest bill (~€25 bn). Education is almost 8× interest costs.

- Luxembourg: Very low debt, very high spending on people. Over €10,000 per person goes to health and education combined, while interest is tiny.

FAQ

Does Italy spend more on debt interest than on education?

Yes, almost. In 2024 Italy spent about €85 bn on interest and €80 bn on education — interest was slightly higher.

Do any EU countries spend more on interest than on healthcare?

No. Even in Italy and Greece, health spending is still larger than interest. But in those countries, interest is two-thirds or more of the health budget.

Which EU country has the biggest interest burden?

Italy. Its interest costs are about 3.9% of GDP — the highest in the EU. Greece follows at around 3%.

Who benefits from low interest burdens?

Citizens in countries like Sweden, Denmark, Germany, and Luxembourg. These countries spend most of their tax money on hospitals, schools, and services, not on debt.

Sources: Eurostat COFOG (government expenditure by function), European Commission, IMF, Reuters, DBRS. Figures mostly for 2024, shown in euros per person where possible.

Further Reading

Analysis & data you might have missed

Europe’s Debt Thermometer, Q2 2025: Who’s Up, Who’s Down — and Why It Matters

New Eurostat data for Q2 2025 reveals a Europe moving in two directions: while some countries’ debt-to-GDP ratios climbed, others managed to bring them down. Here’s what’s driving the shift beneath the surface.

Debt-to-GDP Ratios of EU Countries in 2025

A full overview of government debt across all 27 EU countries in 2025, explained in simple terms with rankings, trends, and key insights.

Ranked: The European Countries Where Every Citizen Owes Over €50,000

Forget the Debt-to-GDP ratio for a moment. When we look at the raw debt burden per citizen, a new and surprising map of Europe emerges. We rank the EU-27 by debt per capita.

Who owns EU government debt in 2025?

Easy-to-read explainer on who holds EU countries’ government bonds — domestic investors, other EU countries, non-EU investors, and the European Central Bank — and why it matters.

Europe's Trillion-Euro Question: When Is National Debt an Investment?

As Europe faces the colossal costs of the green and digital transitions, the old rules of austerity are being challenged by a new logic: borrowing not for consumption, but for survival and future growth.

Ticking Up by €118/Second: Is the Netherlands Still Europe's 'Frugal' Leader?

The Dutch national debt is rising by €118 every second. While its 42.7% debt-to-GDP ratio remains well below the EU limit, this live tracker reveals a more complex picture compared to its European neighbors.