Debt-to-GDP Ratios of EU Countries in 2025

What is Debt-to-GDP?

The debt-to-GDP ratio shows how much money a country owes compared to the size of its economy. If the ratio is 100%, the country owes the same as it produces in one year. A higher number means a heavier debt burden, while a lower number shows a lighter debt load. This measure is often used to compare the financial health of countries.

EU averages in 2025

At the start of 2025, government debt in the European Union was about 82% of GDP. In the euro area (the 20 countries using the euro), the average was even higher, around 88%. EU rules suggest debt should stay below 60%, but more than half of the member states are above this level.

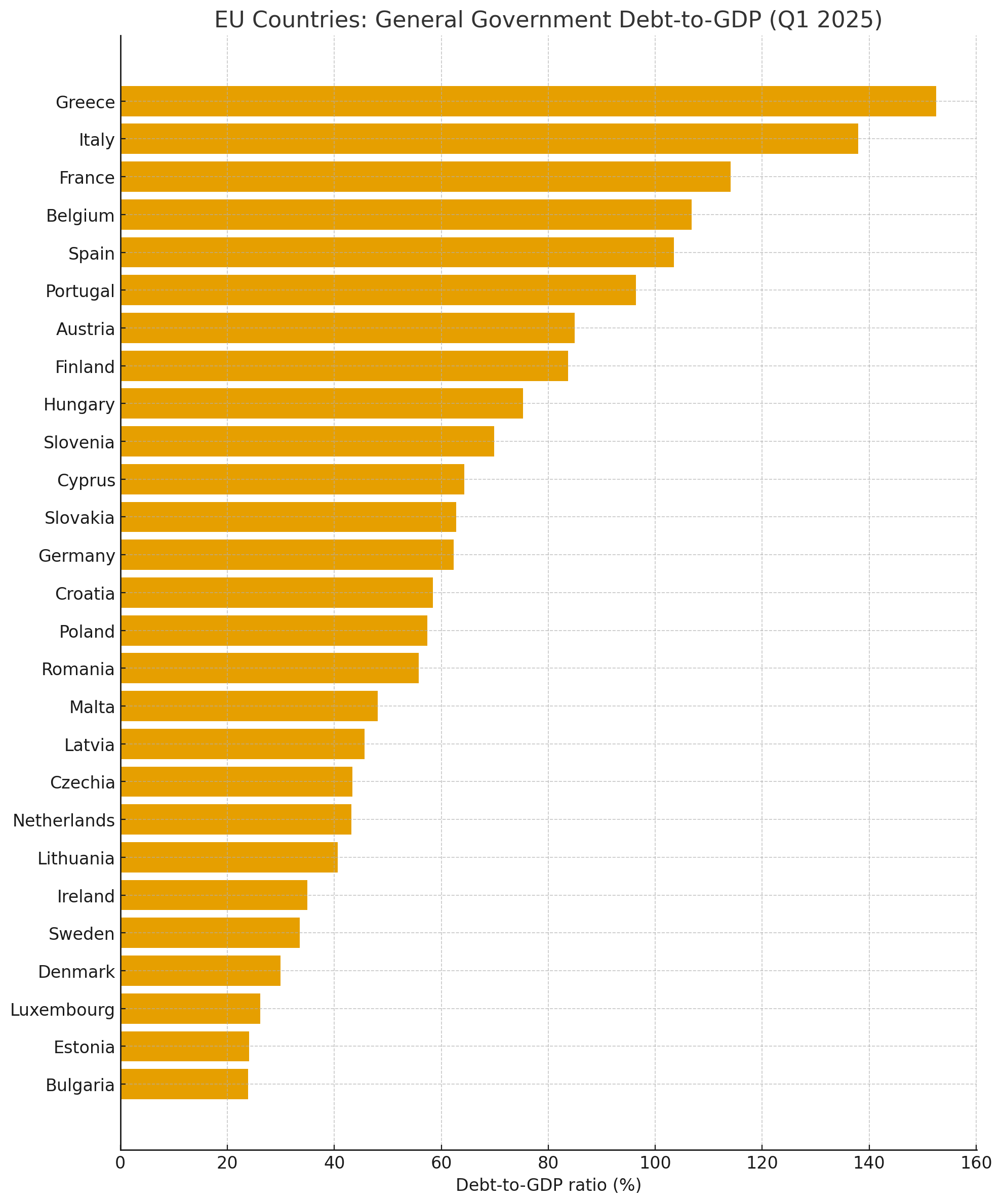

Ranking of EU countries (Q1 2025)

Here is the ranking of all 27 EU countries by their debt-to-GDP ratio in the first quarter of 2025:

| Country | Debt-to-GDP (%) | Change vs end-2024 |

|---|---|---|

| Greece | 152.5 | -1.1 |

| Italy | 137.9 | +2.5 |

| France | 114.1 | +0.9 |

| Belgium | 106.8 | +2.1 |

| Spain | 103.5 | +1.6 |

| Portugal | 96.4 | +1.5 |

| Austria | 84.9 | +3.5 |

| Finland | 83.7 | +1.6 |

| Hungary | 75.3 | +1.8 |

| Slovenia | 69.9 | +2.9 |

| Cyprus | 64.3 | -0.8 |

| Slovakia | 62.8 | +3.5 |

| Germany | 62.3 | -0.1 |

| Croatia | 58.4 | +0.8 |

| Poland | 57.4 | +2.2 |

| Romania | 55.8 | +1.0 |

| Malta | 48.1 | +0.7 |

| Latvia | 45.6 | -1.2 |

| Czechia | 43.4 | 0.0 |

| Netherlands | 43.2 | -0.6 |

| Lithuania | 40.6 | +2.4 |

| Ireland | 34.9 | -3.7 |

| Sweden | 33.5 | -0.4 |

| Denmark | 29.9 | -0.6 |

| Luxembourg | 26.1 | -0.2 |

| Estonia | 24.1 | +0.5 |

| Bulgaria | 23.9 | -0.2 |

Source: Eurostat (gov_10q_ggdebt, Q1 2025)

Top and bottom countries

Highest debt: Greece (152.5%), Italy (137.9%), France (114.1%). These countries carry very heavy debt burdens and are closely watched by financial markets.

Lowest debt: Bulgaria (23.9%), Estonia (24.1%), Luxembourg (26.1%). These countries have strong finances and plenty of room to borrow if needed.

Regional patterns

There is a clear North–South divide in Europe. Southern countries like Greece, Italy, Spain and Portugal have much higher debt. Northern and Eastern countries such as Denmark, Sweden, Estonia and Bulgaria keep debt much lower. Still, there are exceptions: Finland in the north has debt above 80%, while Portugal has managed to cut its debt in recent years.

Why debt levels change

Several key factors explain why some countries’ debt goes up and others’ goes down:

- Economic growth: If GDP grows fast, the ratio usually goes down, even if debt stays the same.

- Inflation: Rising prices increase GDP in money terms, making debt look smaller compared to the economy.

- Government spending: Countries with big budget deficits (spending more than they earn) see debt rise quickly.

- Interest costs: Higher interest rates make debt more expensive to service, especially for high-debt countries like Italy.

Recent changes since 2024

Between early 2024 and early 2025:

- Biggest improvements: Greece (–9.3 points), Cyprus (–8.2), Ireland (–6.1).

- Biggest increases: Poland (+6.1), Finland (+5.1), Austria (+3.5).

This shows that some countries are making progress, while others are still struggling.

Why it matters

High public debt is not just a number. It affects what governments can spend on services like healthcare, education, and infrastructure. It also matters for the stability of the euro area: if a large country like Italy faces debt trouble, it could affect all of Europe. That’s why the EU keeps close watch on these figures.

FAQ

Which EU country has the highest debt in 2025?

Greece, with 152.5% of GDP.

Which country has the lowest debt?

Bulgaria, with just 23.9% of GDP.

What is the EU rule for debt?

The Stability and Growth Pact sets a limit of 60% of GDP. Most EU countries are above this level in 2025.

Has EU debt improved since COVID-19?

Yes, the EU average debt ratio has fallen from about 90% in 2020 to around 82% in 2025. But progress is uneven, with some countries reducing debt fast and others still going up.

Source: Eurostat (gov_10q_ggdebt, Q1 2025), European Commission.

Further Reading

Analysis & data you might have missed

Ticking Up by €118/Second: Is the Netherlands Still Europe's 'Frugal' Leader?

The Dutch national debt is rising by €118 every second. While its 42.7% debt-to-GDP ratio remains well below the EU limit, this live tracker reveals a more complex picture compared to its European neighbors.

Born with a €58,000 Mortgage? The 2026 Debt-per-Capita Map of Europe

New 2026 projections reveal a massive financial divide. While a Dutch citizen needs 9 months of work to pay off their share of the national debt, an Italian needs over 2 years.

France’s public debt in 2025: what the numbers tell us

A clear, student-friendly explainer of France’s debt and deficit in 2025, why politics matter, and what this means for Europe.

The Hidden Debt Time Bomb in the Eurozone — Expanded Analysis

With the euro area’s debt reaching 88 percent of GDP, Europe confronts a perilous mix of weak growth, rising rates, and fractured politics that threaten fiscal stability.

Germany’s Debt Paradox: How Fiscal Discipline Became an Economic Trap

Germany’s falling debt-to-GDP ratio hides a deeper problem. Bound by its strict 'debt brake' while facing urgent needs for investment, Europe’s largest economy is caught between prudence and paralysis.

Can the US Handle More Debt Than Europe?

Several EU countries are already above 100% debt-to-GDP, just like the United States. Yet markets treat US debt very differently. This article explains why.